When it pertains to building or refurbishing your home, among one of the most important actions is producing a well-thought-out house plan. This plan acts as the foundation for your dream home, influencing whatever from design to building style. In this short article, we'll delve into the complexities of house planning, covering crucial elements, influencing aspects, and emerging fads in the realm of architecture.

VA Lending And Property Tax Exemptions For Veterans Homeowners

Tax Planning For House Property

To place a property into service you must meet two requirements 1 the property must be ready for use and 2 the property must be available for use Generally your rental is ready for use when the city or locality of your rental property will conservatively issue a Certificate of Occupancy

A successful Tax Planning For House Propertyincludes different components, consisting of the overall format, area distribution, and architectural features. Whether it's an open-concept design for a spacious feel or a much more compartmentalized design for personal privacy, each element plays an important duty fit the capability and appearances of your home.

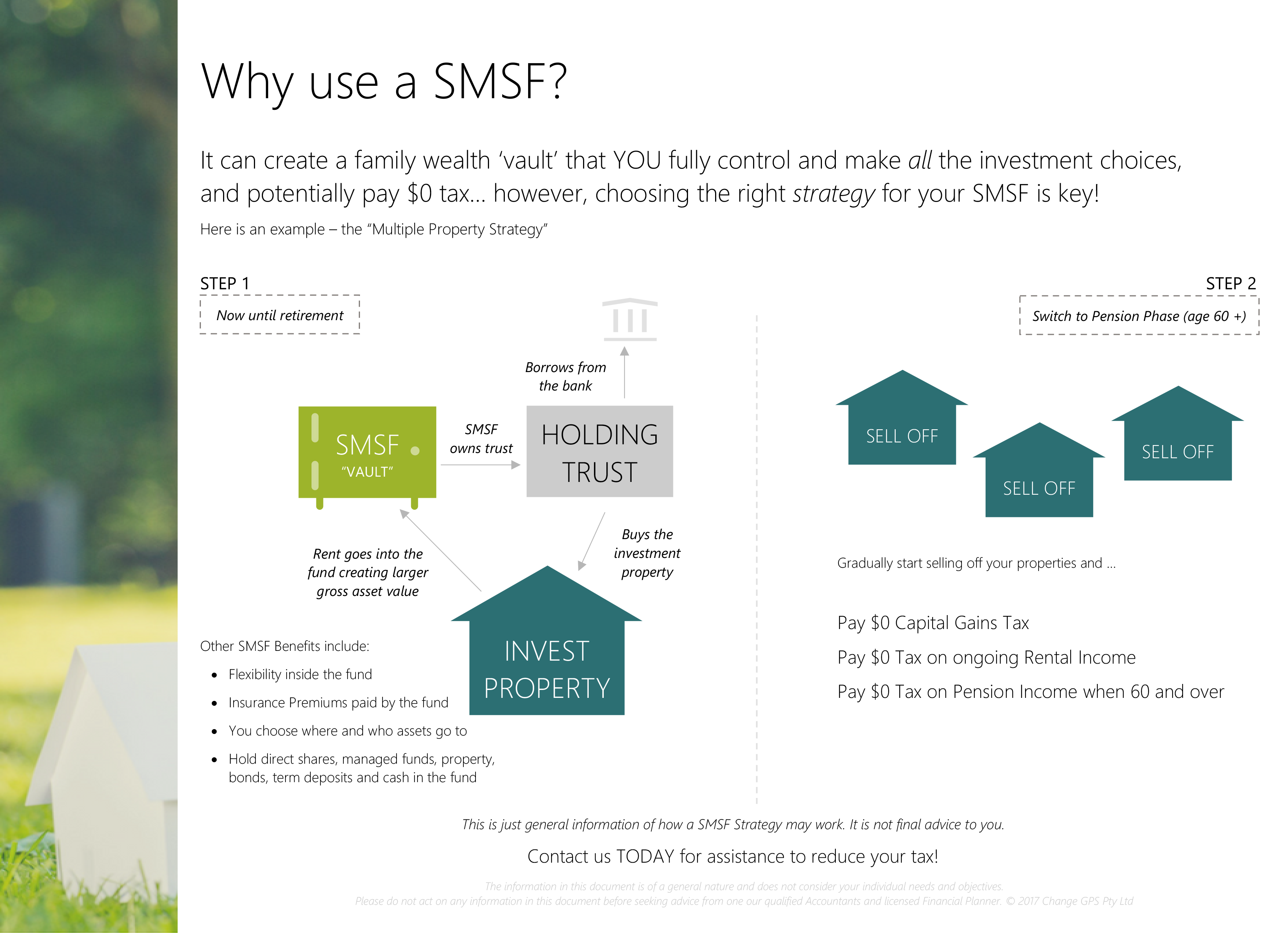

Pdfpreview Tax Planning Infographic 4 Why Use A SMSF docx Precision Taxation Accounting

Pdfpreview Tax Planning Infographic 4 Why Use A SMSF docx Precision Taxation Accounting

Your area s property tax levy can be found on your local tax assessor or municipality website and it s typically represented as a percentage like 4 To estimate your real estate taxes you

Creating a Tax Planning For House Propertyrequires cautious factor to consider of aspects like family size, way of living, and future demands. A household with little ones may focus on play areas and safety and security functions, while empty nesters may concentrate on developing areas for leisure activities and leisure. Comprehending these elements makes certain a Tax Planning For House Propertythat caters to your special requirements.

From traditional to modern-day, different architectural styles affect house plans. Whether you favor the ageless allure of colonial style or the sleek lines of contemporary design, exploring different designs can aid you find the one that resonates with your taste and vision.

In an era of environmental consciousness, sustainable house plans are obtaining appeal. Incorporating environment-friendly products, energy-efficient devices, and smart design concepts not just reduces your carbon footprint but likewise produces a healthier and even more economical home.

Significance Of Tax Planning By Lifeline Tax Issuu

Significance Of Tax Planning By Lifeline Tax Issuu

In addition to the federal estate tax 17 states and Washington D C impose an estate or inheritance tax Those states are Connecticut Hawaii Illinois Iowa Kentucky Maine Maryland

Modern house plans often incorporate modern technology for enhanced comfort and comfort. Smart home attributes, automated lighting, and incorporated safety systems are just a couple of examples of exactly how modern technology is shaping the way we design and live in our homes.

Producing a practical spending plan is an important element of house planning. From building costs to interior surfaces, understanding and alloting your budget efficiently makes certain that your dream home doesn't develop into an economic headache.

Making a decision in between designing your very own Tax Planning For House Propertyor employing a professional architect is a significant consideration. While DIY plans use an individual touch, experts bring expertise and make certain conformity with building ordinance and guidelines.

In the excitement of intending a new home, usual mistakes can take place. Oversights in space dimension, inadequate storage, and ignoring future needs are pitfalls that can be stayed clear of with mindful consideration and preparation.

For those dealing with restricted area, enhancing every square foot is necessary. Smart storage space options, multifunctional furniture, and critical area layouts can transform a cottage plan into a comfortable and practical living space.

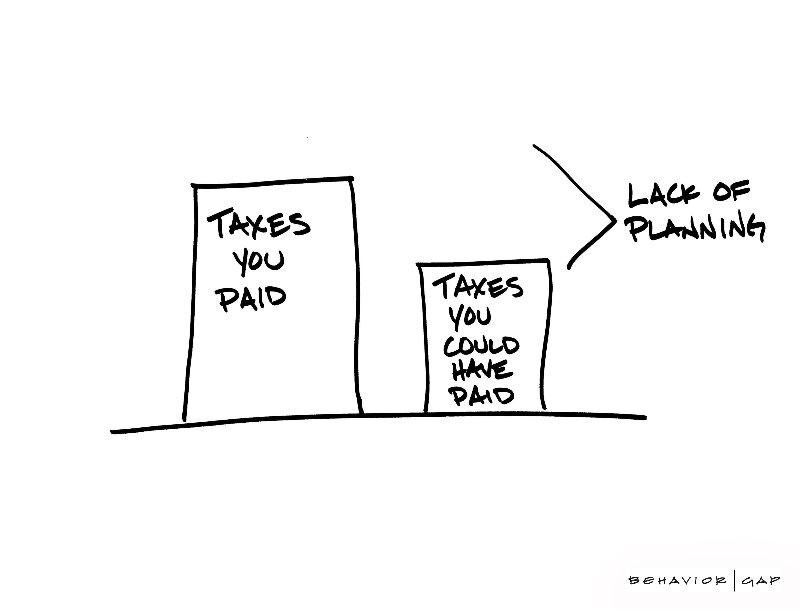

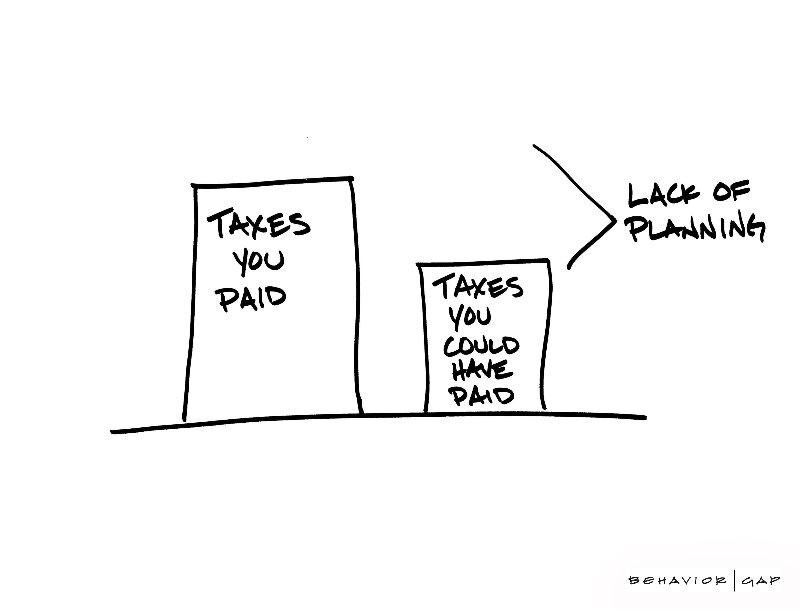

Goldstone Financial Group Tax Planning Services More

Goldstone Financial Group Tax Planning Services More

Tax planning is a crucial aspect of successful real estate investment It involves understanding and applying tax laws regulations and strategies to minimize tax liabilities and maximize returns on investments The primary objectives of tax planning for real estate include reducing taxable income taking advantage of tax credits and

As we age, availability ends up being a crucial consideration in house planning. Including features like ramps, broader doorways, and easily accessible washrooms ensures that your home remains ideal for all phases of life.

The world of design is vibrant, with brand-new trends forming the future of house preparation. From sustainable and energy-efficient layouts to cutting-edge use products, staying abreast of these trends can influence your own one-of-a-kind house plan.

In some cases, the best way to understand efficient house planning is by checking out real-life examples. Case studies of successfully performed house plans can supply insights and inspiration for your own job.

Not every homeowner starts from scratch. If you're restoring an existing home, thoughtful planning is still essential. Examining your existing Tax Planning For House Propertyand recognizing areas for enhancement makes certain an effective and rewarding improvement.

Crafting your desire home begins with a properly designed house plan. From the first format to the finishing touches, each component adds to the general performance and appearances of your space. By taking into consideration aspects like family requirements, architectural styles, and emerging patterns, you can create a Tax Planning For House Propertythat not only satisfies your current needs but additionally adapts to future modifications.

Here are the Tax Planning For House Property

Download Tax Planning For House Property

https://www.stessa.com/blog/real-estate-tax-strategies-for-2022/

To place a property into service you must meet two requirements 1 the property must be ready for use and 2 the property must be available for use Generally your rental is ready for use when the city or locality of your rental property will conservatively issue a Certificate of Occupancy

https://www.realtor.com/guides/homeowners-guide-to-taxes/how-to-calculate-property-tax/

Your area s property tax levy can be found on your local tax assessor or municipality website and it s typically represented as a percentage like 4 To estimate your real estate taxes you

To place a property into service you must meet two requirements 1 the property must be ready for use and 2 the property must be available for use Generally your rental is ready for use when the city or locality of your rental property will conservatively issue a Certificate of Occupancy

Your area s property tax levy can be found on your local tax assessor or municipality website and it s typically represented as a percentage like 4 To estimate your real estate taxes you

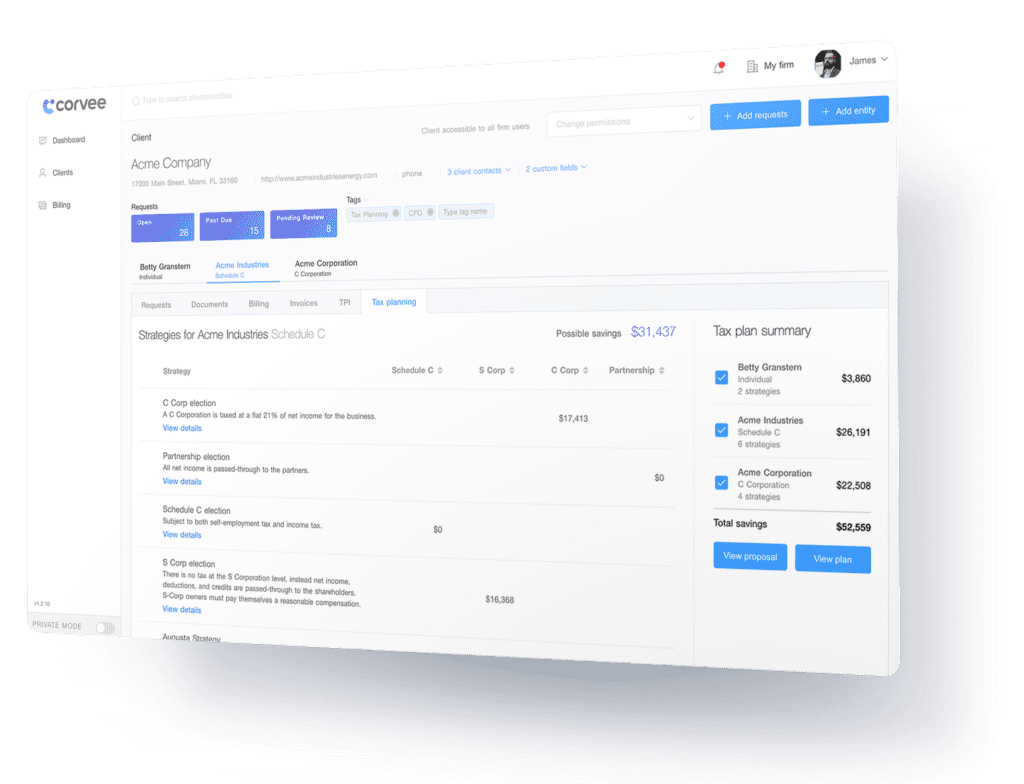

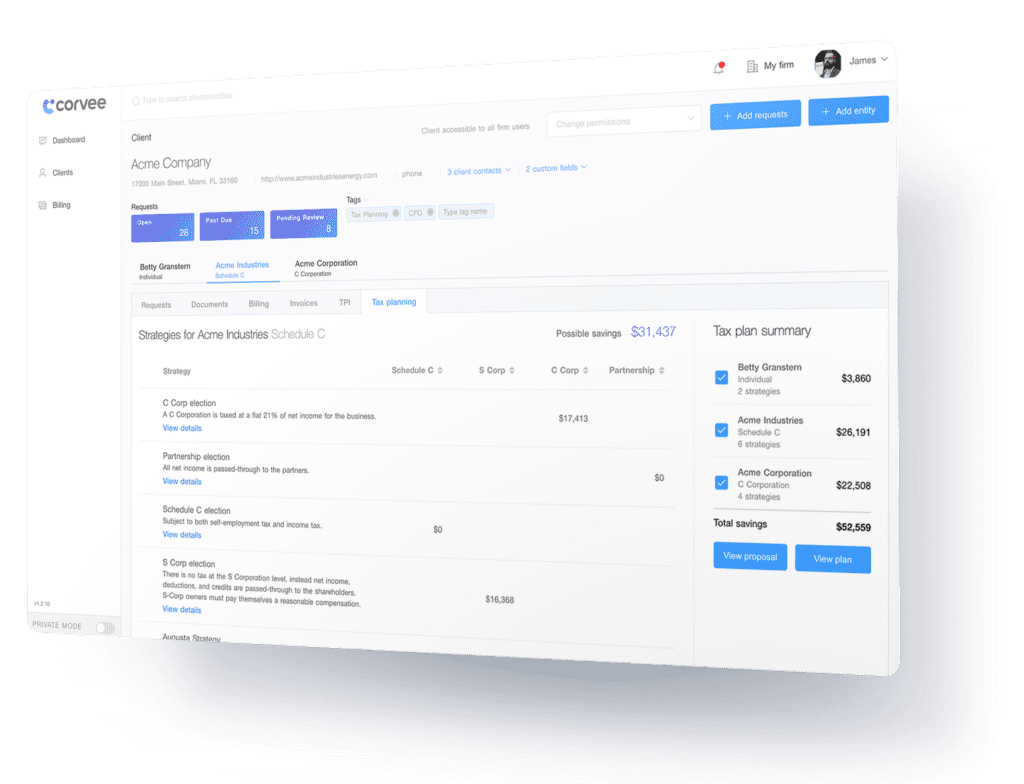

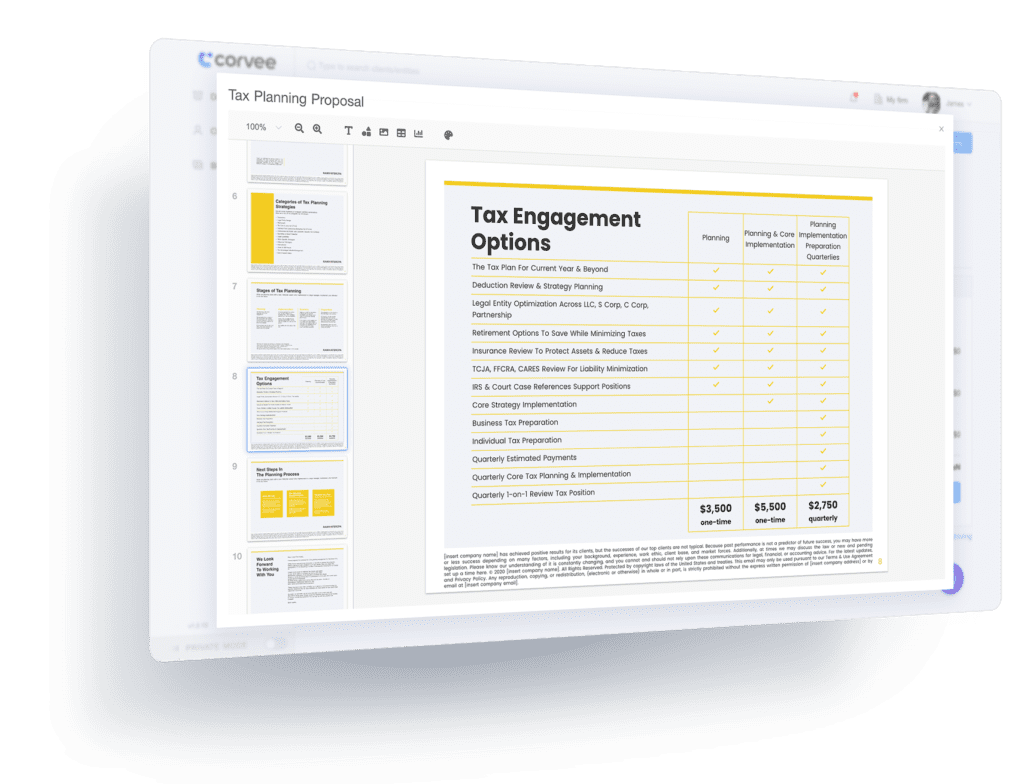

Use Tax Planner Software To Offer Tax Planning Corvee

Tax Planning Destiny Capital

Tax Planning Under The New Tax Bill Redwood Grove Wealth Management

2009 Tax Planning

Grow And Optimize Your Medium Or Large Tax Firm Corvee

Tax Planning Services For Retirement Savers

Tax Planning Services For Retirement Savers

Certified Concierge Tax Accountant Tax Planning Masterclass