When it comes to structure or refurbishing your home, among one of the most vital steps is developing a well-balanced house plan. This plan acts as the structure for your desire home, affecting whatever from design to building design. In this article, we'll delve into the intricacies of house planning, covering key elements, influencing factors, and emerging fads in the world of architecture.

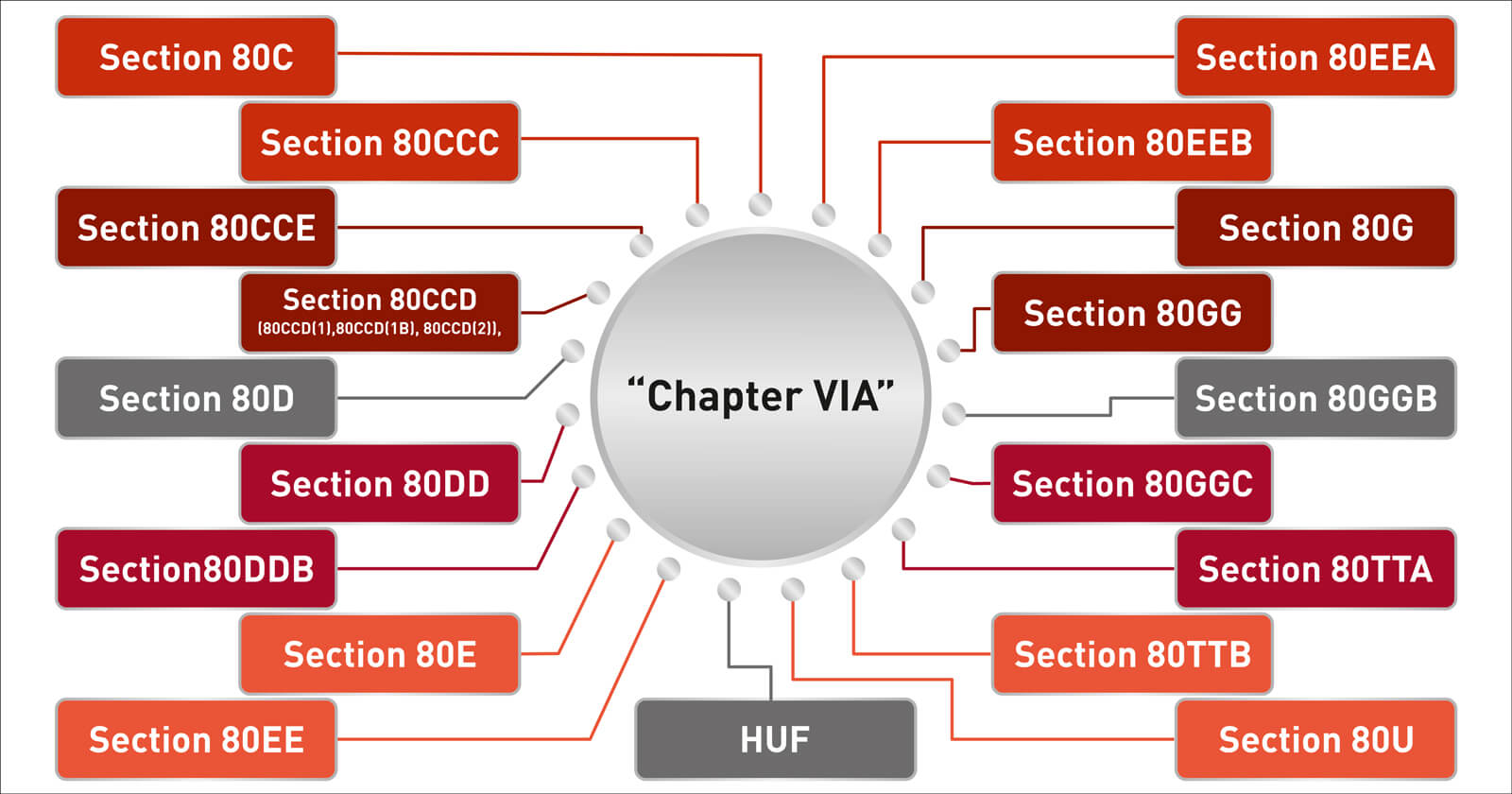

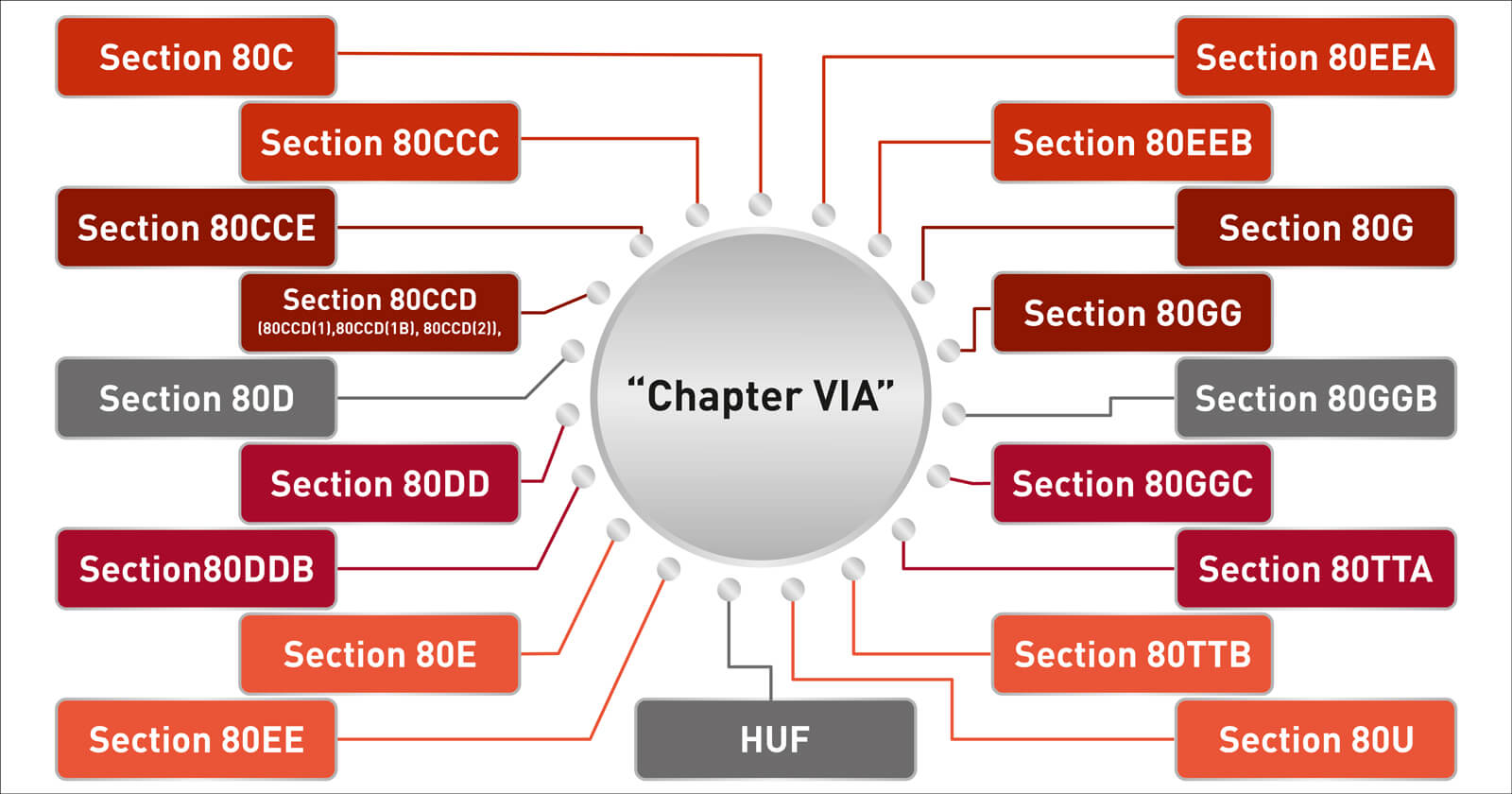

Deductions Under Chapter VIA

Capital Investment Deductions Under House Senate Tax Plans

New bipartisan legislation the Tax increasing the amount of investment that a small business can immediately write off to 1 29 million from the 1 million cap enacted in 2017 Senate

An effective Capital Investment Deductions Under House Senate Tax Plansencompasses various components, consisting of the overall format, room circulation, and architectural functions. Whether it's an open-concept design for a sizable feeling or an extra compartmentalized layout for privacy, each component plays a critical role fit the capability and looks of your home.

Dueling Tax Plans Here s What The Senate And House Have To Resolve

Dueling Tax Plans Here s What The Senate And House Have To Resolve

Published January 20 2021 President Biden s Build Back Better social spending and tax bill is slowly working its way through Congress It was recently passed by the House of Representatives

Designing a Capital Investment Deductions Under House Senate Tax Planscalls for mindful factor to consider of factors like family size, way of living, and future demands. A family members with young kids might prioritize backyard and security features, while vacant nesters could focus on creating rooms for leisure activities and leisure. Understanding these aspects guarantees a Capital Investment Deductions Under House Senate Tax Plansthat accommodates your distinct requirements.

From standard to modern-day, numerous architectural designs influence house strategies. Whether you favor the timeless charm of colonial style or the smooth lines of modern design, exploring various designs can aid you find the one that resonates with your taste and vision.

In an age of environmental consciousness, lasting house plans are obtaining popularity. Incorporating environmentally friendly materials, energy-efficient devices, and wise design principles not just minimizes your carbon footprint however also develops a much healthier and more affordable living space.

House And Senate Tax Plans Share Common Ground Senate Legislative

House And Senate Tax Plans Share Common Ground Senate Legislative

The interest expense limitation allowed is 30 of adjusted taxable income plus floor plan financing interest For taxable years beginning before January 1 2022 taxpayers were allowed to add back

Modern house plans commonly integrate innovation for boosted comfort and convenience. Smart home functions, automated illumination, and integrated safety systems are just a few examples of just how technology is shaping the way we design and stay in our homes.

Producing a sensible budget is a crucial element of house preparation. From construction costs to indoor surfaces, understanding and assigning your spending plan properly makes certain that your dream home does not turn into an economic problem.

Making a decision between making your own Capital Investment Deductions Under House Senate Tax Plansor employing a specialist architect is a significant consideration. While DIY plans provide an individual touch, professionals bring know-how and ensure conformity with building codes and regulations.

In the enjoyment of planning a brand-new home, usual mistakes can happen. Oversights in room size, inadequate storage, and overlooking future requirements are mistakes that can be avoided with careful factor to consider and preparation.

For those working with minimal area, optimizing every square foot is vital. Smart storage remedies, multifunctional furnishings, and calculated area layouts can change a small house plan right into a comfy and useful space.

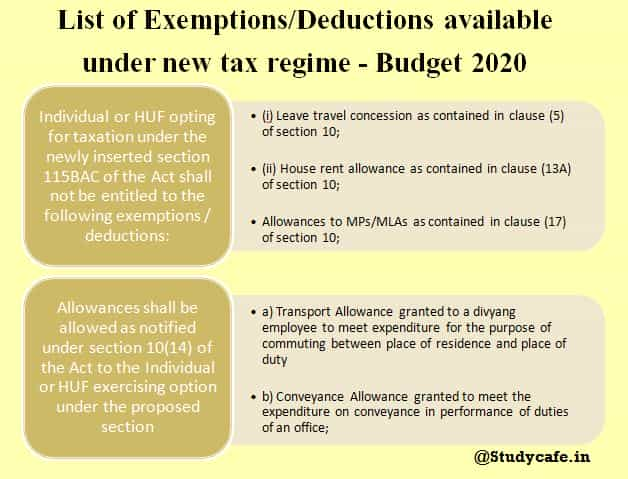

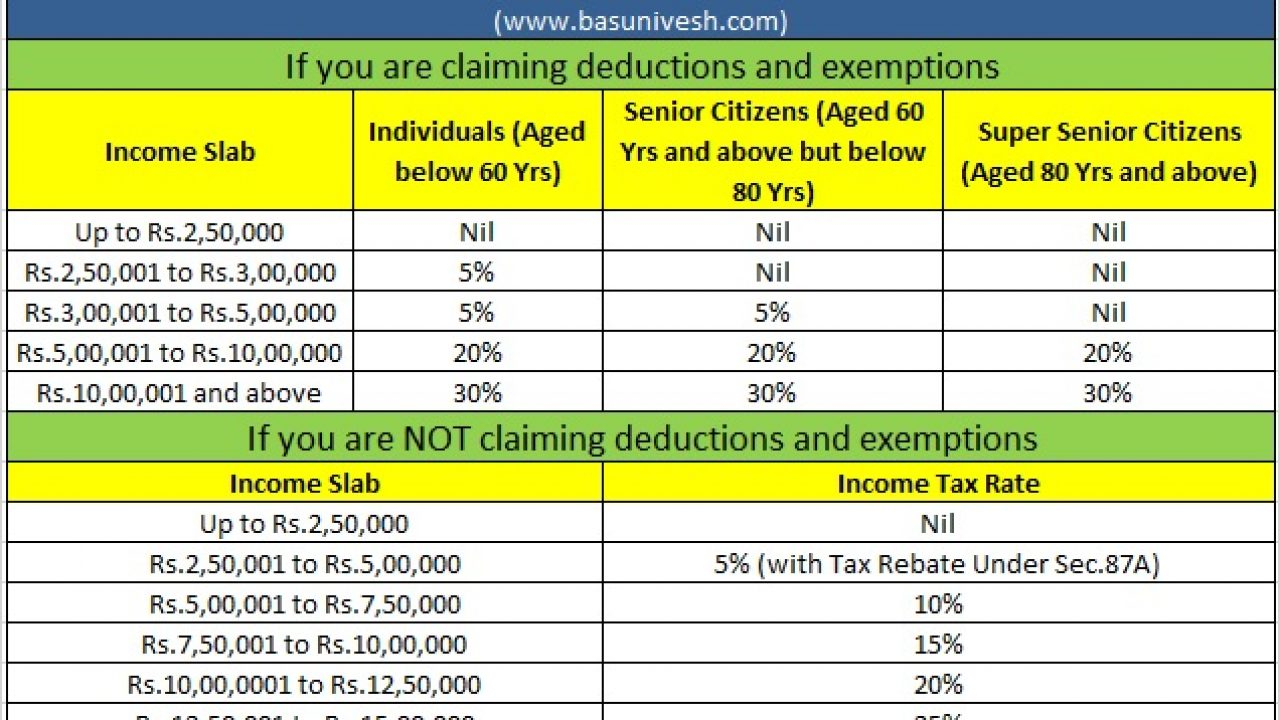

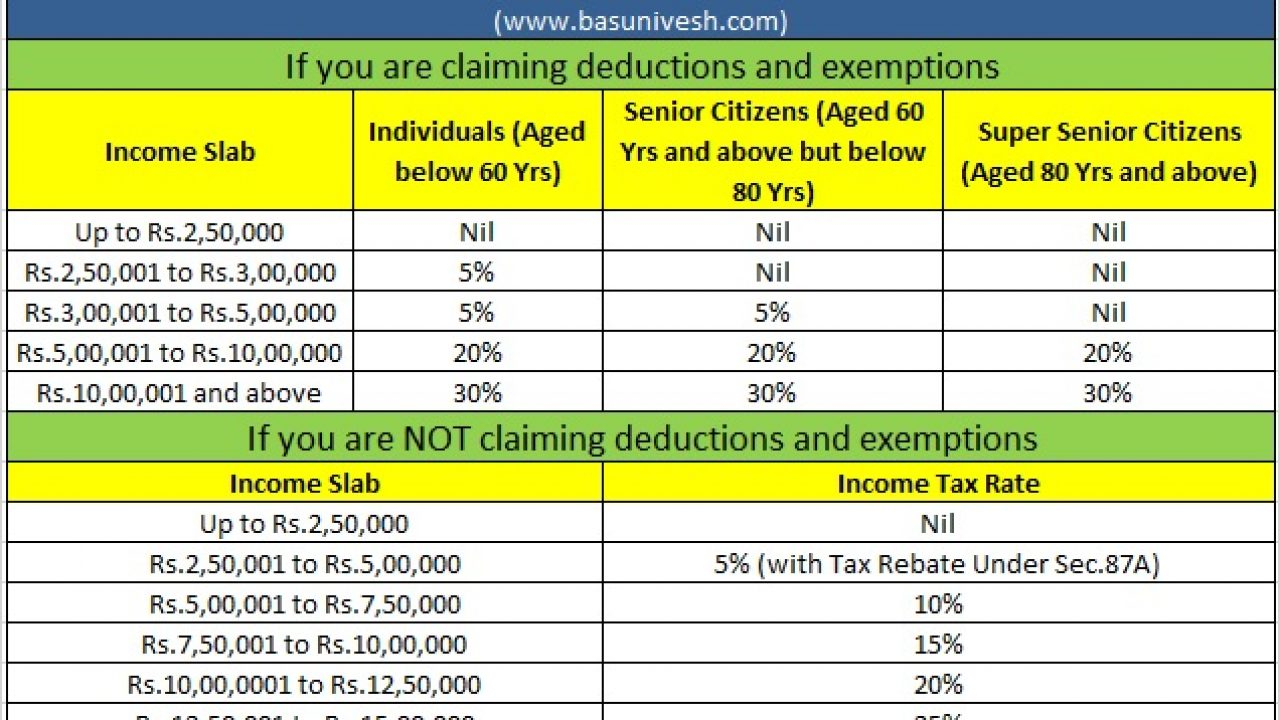

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

One thing that is not in the Senate version is any change in the current through 2025 cap on itemized deductions of state and local taxes under Sec 164 b The House version would increase the current 10 000 limit to 80 000 40 000 for married taxpayers filing separately and trusts and estates

As we age, access ends up being an essential consideration in house preparation. Including functions like ramps, bigger entrances, and available shower rooms makes sure that your home remains suitable for all phases of life.

The globe of style is dynamic, with new patterns forming the future of house preparation. From sustainable and energy-efficient styles to innovative use of products, remaining abreast of these trends can motivate your very own one-of-a-kind house plan.

Occasionally, the most effective method to understand reliable house preparation is by considering real-life instances. Study of successfully carried out house strategies can provide insights and inspiration for your own job.

Not every house owner goes back to square one. If you're renovating an existing home, thoughtful planning is still important. Assessing your existing Capital Investment Deductions Under House Senate Tax Plansand identifying areas for enhancement ensures an effective and rewarding improvement.

Crafting your desire home begins with a well-designed house plan. From the initial design to the complements, each aspect adds to the overall performance and appearances of your living space. By considering elements like household requirements, building styles, and emerging trends, you can create a Capital Investment Deductions Under House Senate Tax Plansthat not just satisfies your existing requirements however also adapts to future adjustments.

Download More Capital Investment Deductions Under House Senate Tax Plans

Download Capital Investment Deductions Under House Senate Tax Plans

https://www.thinkadvisor.com/2024/01/29/tax-bill-with-100-bonus-depreciation-may-get-house-vote-this-week/

New bipartisan legislation the Tax increasing the amount of investment that a small business can immediately write off to 1 29 million from the 1 million cap enacted in 2017 Senate

https://www.kiplinger.com/taxes/602109/build-back-better-tax-passed-in-house

Published January 20 2021 President Biden s Build Back Better social spending and tax bill is slowly working its way through Congress It was recently passed by the House of Representatives

New bipartisan legislation the Tax increasing the amount of investment that a small business can immediately write off to 1 29 million from the 1 million cap enacted in 2017 Senate

Published January 20 2021 President Biden s Build Back Better social spending and tax bill is slowly working its way through Congress It was recently passed by the House of Representatives

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

How Could A Tax Change Affect You This Is What The Senate And House

Senate Tax Cut Package Lowers Personal Rates Phases Out Corporate Tax

Trump Tax Plan Senate Bill Would Raise Taxes On 16 Million In 2019

Tax Policy And The Family Cornerstone

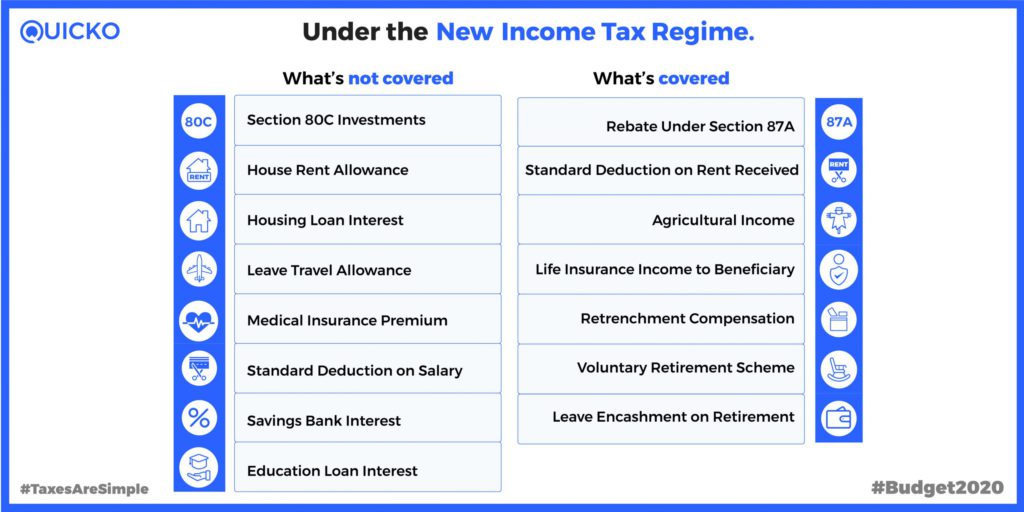

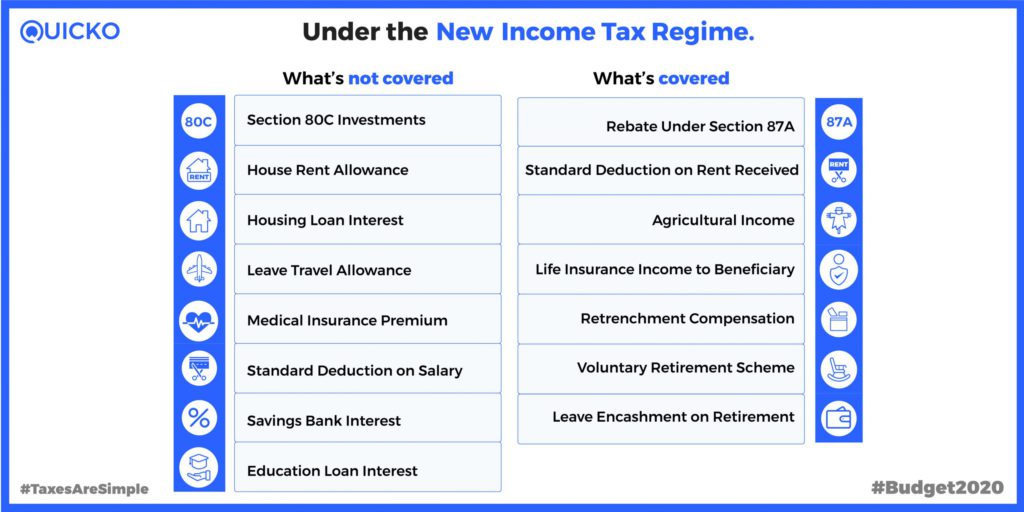

Deductions Under The New Tax Regime Budget 2020 Quicko Blog

Deductions Under The New Tax Regime Budget 2020 Quicko Blog

Everything You Need To Know About The Senate GOP Tax Plan Crain s