When it involves building or remodeling your home, among the most important actions is producing a well-balanced house plan. This plan serves as the foundation for your desire home, affecting whatever from design to architectural design. In this post, we'll explore the intricacies of house preparation, covering crucial elements, affecting aspects, and arising trends in the world of architecture.

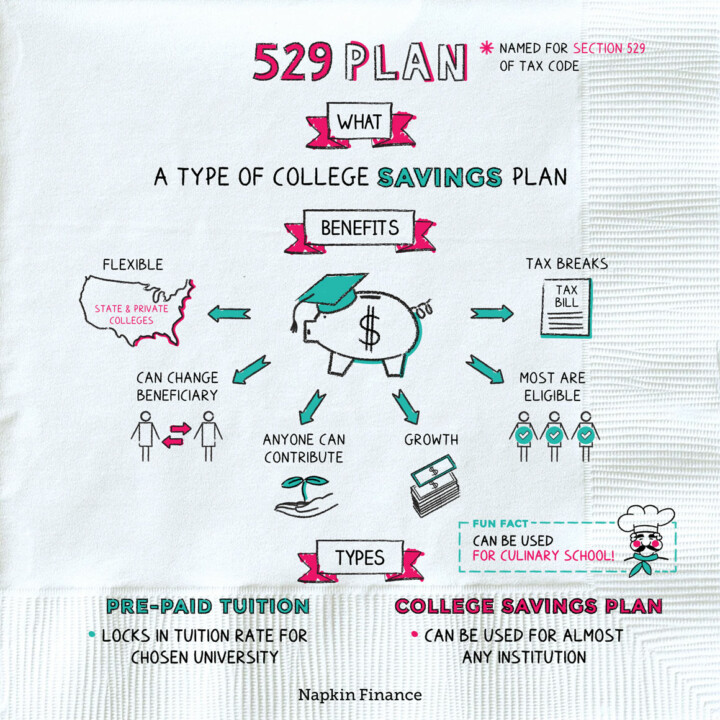

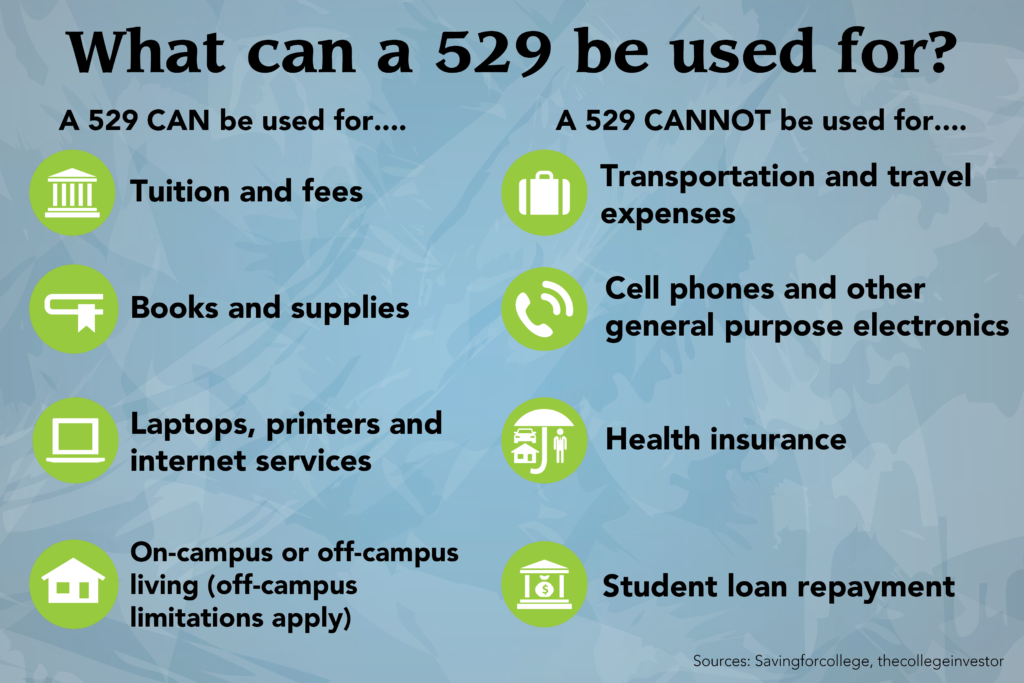

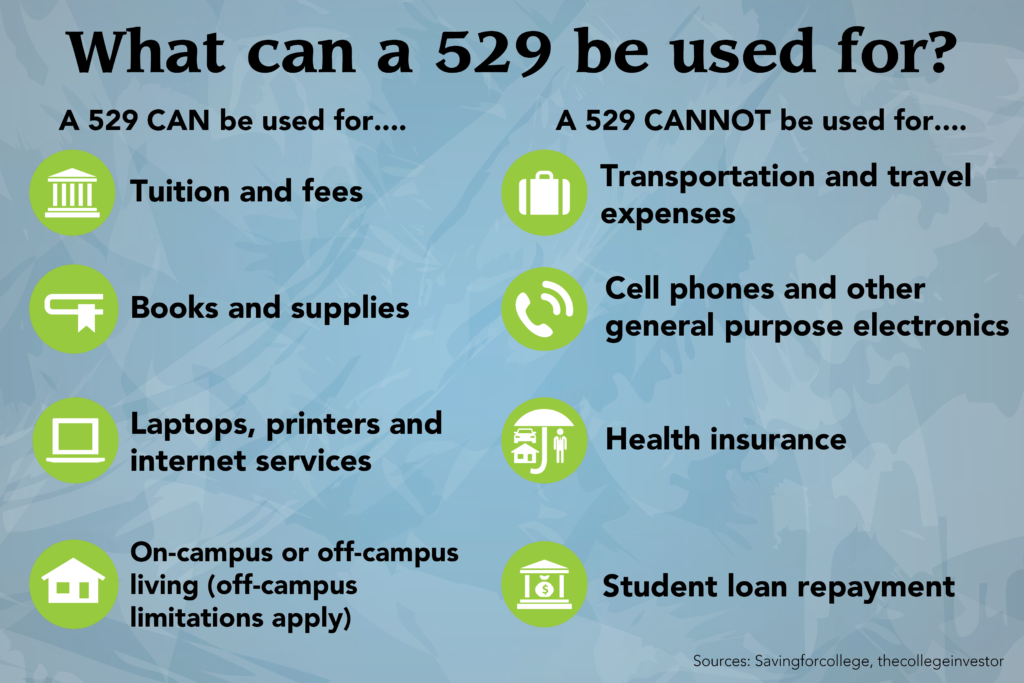

All About 529 Plans InfographicBee

529 Plan Housing Rules

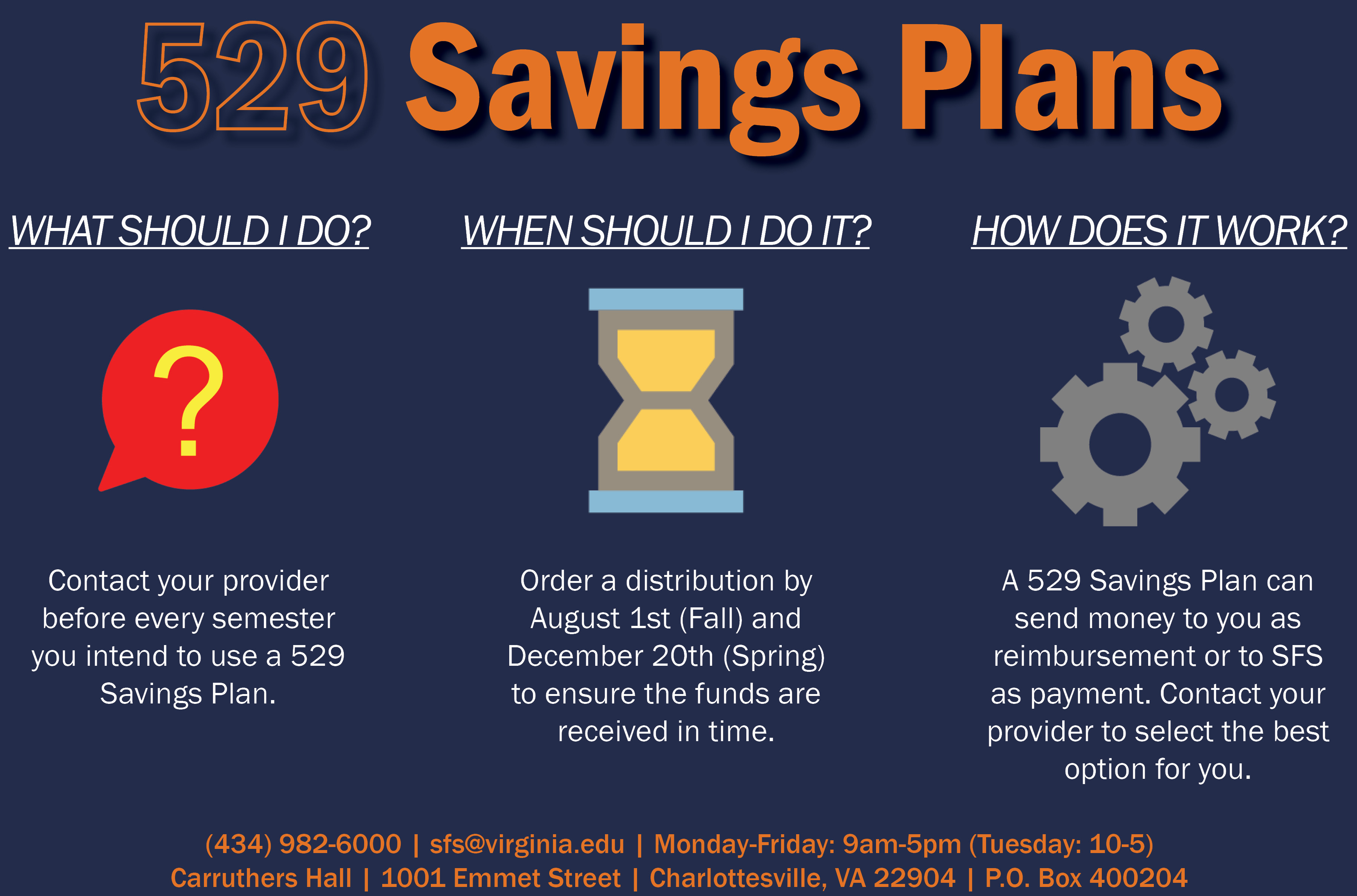

1 Determine the Amount of Qualified Expenses There is no annual limit on how much you can withdraw for college expenses but there are limits on certain expenses An annual withdrawal limit of

An effective 529 Plan Housing Rulesincorporates various components, including the total design, space circulation, and architectural features. Whether it's an open-concept design for a roomy feeling or a more compartmentalized layout for personal privacy, each aspect plays an essential duty fit the capability and aesthetic appeals of your home.

What Is A 529 Plan Napkin Finance

What Is A 529 Plan Napkin Finance

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

Designing a 529 Plan Housing Rulescalls for mindful consideration of elements like family size, way of living, and future requirements. A family members with young kids may focus on play areas and safety features, while empty nesters might focus on creating rooms for hobbies and leisure. Understanding these variables ensures a 529 Plan Housing Rulesthat satisfies your special needs.

From traditional to modern, different building designs affect house strategies. Whether you choose the classic appeal of colonial design or the smooth lines of modern design, discovering different styles can assist you discover the one that reverberates with your preference and vision.

In an age of ecological consciousness, sustainable house strategies are acquiring appeal. Integrating environment-friendly materials, energy-efficient home appliances, and clever design principles not only reduces your carbon footprint but likewise creates a much healthier and more cost-efficient space.

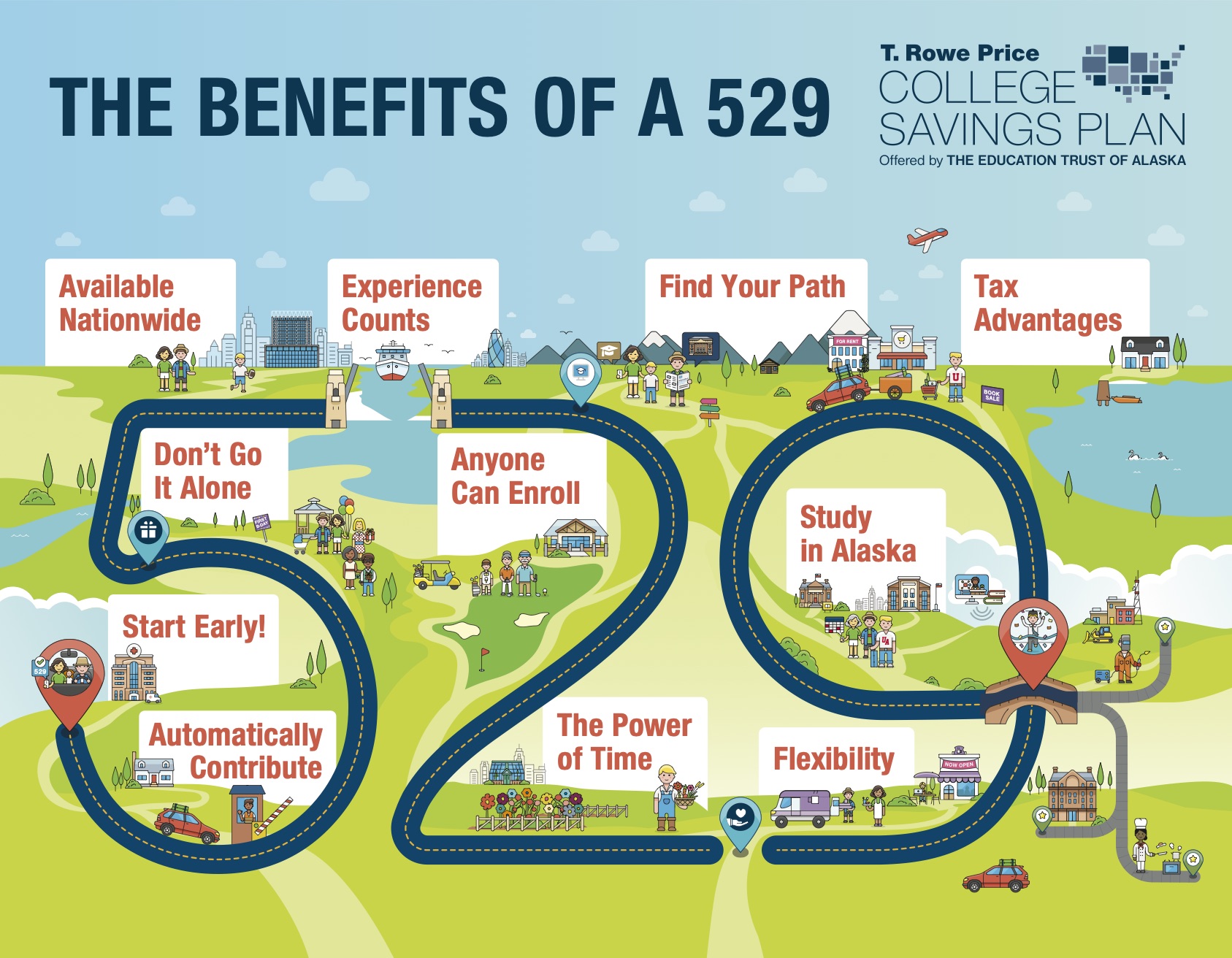

May 29 Is 529 Plan Day Access Wealth

May 29 Is 529 Plan Day Access Wealth

July 27 2023 A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses

Modern house plans commonly integrate modern technology for enhanced comfort and comfort. Smart home attributes, automated lights, and integrated protection systems are just a few instances of just how technology is forming the means we design and live in our homes.

Creating a reasonable spending plan is a vital aspect of house planning. From building costs to indoor coatings, understanding and designating your budget plan efficiently guarantees that your desire home doesn't become a financial problem.

Choosing between creating your own 529 Plan Housing Rulesor hiring an expert engineer is a considerable factor to consider. While DIY strategies use an individual touch, professionals bring knowledge and make sure compliance with building regulations and guidelines.

In the enjoyment of planning a brand-new home, common errors can happen. Oversights in area dimension, poor storage space, and ignoring future needs are risks that can be prevented with cautious consideration and planning.

For those dealing with limited room, optimizing every square foot is essential. Brilliant storage space remedies, multifunctional furnishings, and strategic space formats can change a cottage plan right into a comfy and practical space.

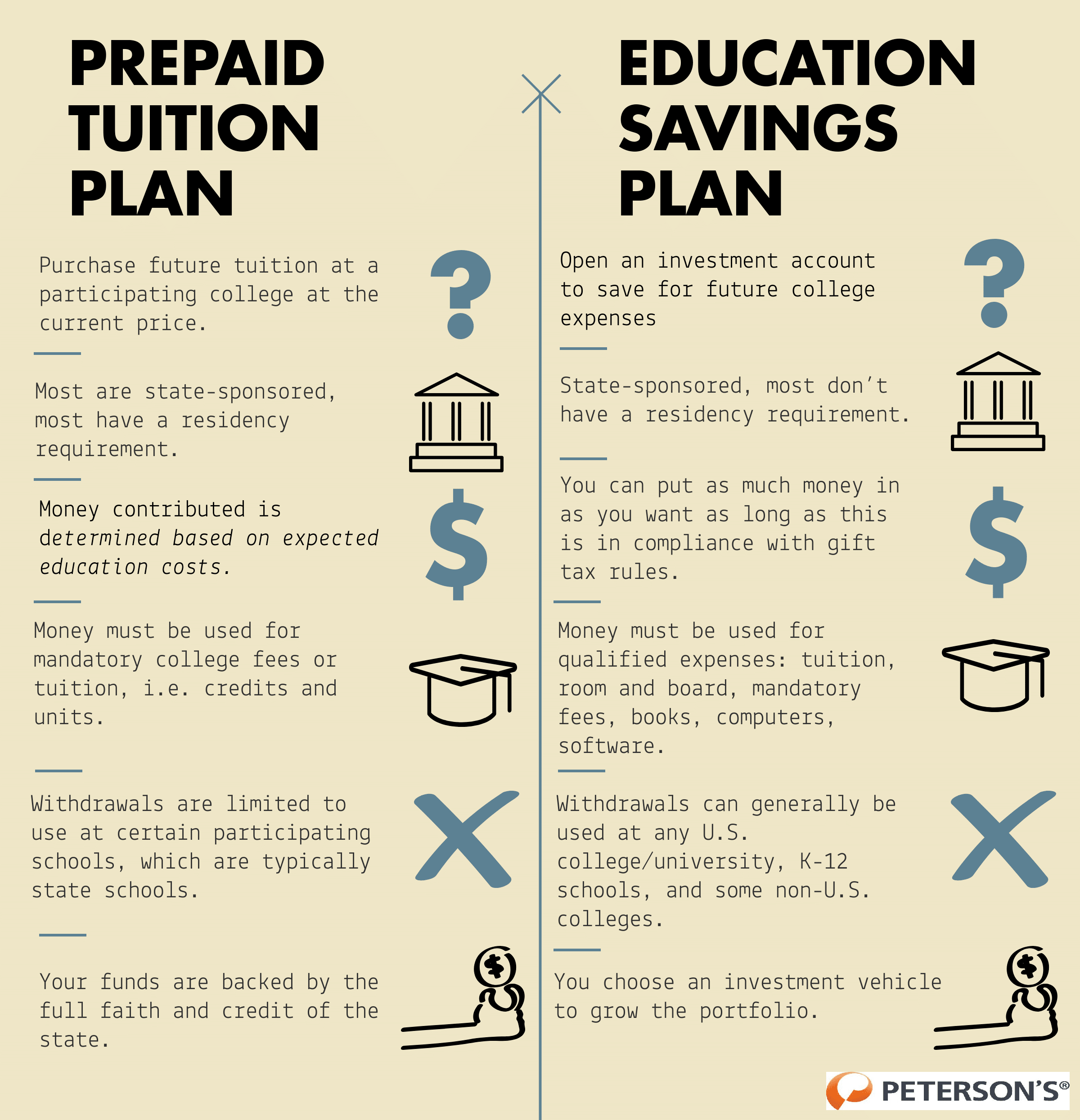

529 Plan Comparison Chart

529 Plan Comparison Chart

Plan beneficiaries can roll up to 35 000 into that Roth IRA starting in 2024 as long as the account has been open at least 15 years That s just one of the rules of 529 plans There are

As we age, availability ends up being a crucial factor to consider in house preparation. Integrating functions like ramps, larger doorways, and easily accessible bathrooms guarantees that your home continues to be appropriate for all stages of life.

The globe of style is vibrant, with brand-new patterns shaping the future of house planning. From lasting and energy-efficient designs to innovative use of products, staying abreast of these fads can motivate your very own special house plan.

Sometimes, the most effective method to understand efficient house preparation is by looking at real-life examples. Case studies of successfully executed house strategies can provide understandings and inspiration for your own task.

Not every home owner goes back to square one. If you're renovating an existing home, thoughtful planning is still important. Analyzing your existing 529 Plan Housing Rulesand identifying locations for enhancement makes certain a successful and gratifying improvement.

Crafting your dream home begins with a well-designed house plan. From the first format to the complements, each aspect adds to the overall functionality and looks of your living space. By taking into consideration variables like household demands, architectural designs, and arising patterns, you can produce a 529 Plan Housing Rulesthat not just satisfies your existing demands yet likewise adjusts to future adjustments.

Download 529 Plan Housing Rules

Download 529 Plan Housing Rules

https://www.forbes.com/advisor/student-loans/529-plan-withdrawal-rules/

1 Determine the Amount of Qualified Expenses There is no annual limit on how much you can withdraw for college expenses but there are limits on certain expenses An annual withdrawal limit of

https://www.kiplinger.com/article/college/t002-c001-s001-paying-for-off-campus-housing-with-a-529-plan.html

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

1 Determine the Amount of Qualified Expenses There is no annual limit on how much you can withdraw for college expenses but there are limits on certain expenses An annual withdrawal limit of

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

What To Do With Leftover Money In A 529 Plan Financial Samurai 529 Plan How To Plan

529 College Savings Plan Tips And Tricks 529 College Savings Plan College Costs Saving For

529 Plan Rules And Uses Of 529 Plan Advantages And Disadvantages

What You Need To Know About 529 Plans CNBconnect

Understanding 529 Plans Infographic

If 529 Plans Get Taxed Here s Another Tax free Option

If 529 Plans Get Taxed Here s Another Tax free Option

Significant Changes In 529 Plan Rules May Benefit Families Acumen Wealth Advisors